Earn 9.6% for 6 Months Guaranteed!

More on Earning 9.62 Percent Tax-Deferred

You can buy from now through October 31, 2022, Series I bonds from the U.S Treasury that pay 9.62 percent tax-deferred interest.

If you buy now, you earn that 9.62 percent for six months, guaranteed. At the end of six months, the Treasury Department

- adds the interest you earned to your principal, and

- pays interest on your new principal balance at the new rate it will determine this year, on November 1.

Example. You buy $10,000 of I bonds on September 24. You earn 9.62 percent for six months for a total of $481 ($10,000 x 9.62 percent ÷ 2). On March 24, your principal balance is $10,481 ($10,000 + 481).

Let’s say Treasury sets the November 1 interest rate at 9 percent. During the six months from March 24 to September 24, 2023, you earn interest at 9 percent on $10,481. Now, at the end of a full year, you have $10,953 in your TreasuryDirect I bond account.

The big deal with an I bond is four-fold:

- You can’t lose your principal (e.g., your $10,953 in the example above can’t go down).

- Interest rates on I bonds track with the consumer price index inflation rate, which has been high.

- You earn tax-deferred compound interest until you cash in.

- The interest is exempt from state and local income taxes.

Okay, you got all that… And you got the downside, which is that you can buy only $10,000 of I bonds online and another $5,000 of paper bonds with a tax refund.

Online Purchases

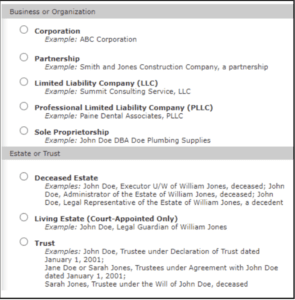

Let’s stay with online purchases. You, your spouse, your LLC, your living trust, and your corporations can buy up to $10,000 each online. And you can do this each calendar year. Here are the opportunities for purchase that you see when you apply for a new I bond account:

Example. Henry and Hilda are married, operate two corporations, have a living trust, and have an LLC that owns their rental property. They can have six online accounts at TreasuryDirect:

- Henry personal

- Hilda personal

- Corporation 1

- Corporation 2

- Living trust

- LLC

With six accounts, Henry and Hilda can purchase up to $60,000 of I bonds this calendar year and another $60,000 in January 2023 for calendar year 2023. So at the end of January 2023, they can have $120,000 of I bonds in their electronic accounts at TreasuryDirect.

Tax Return Purchase

You can buy up to $5,000 of paper I bonds using your personal federal income tax refund. 1

One sad part of this option is that the $5,000 limit applies per personal tax return. Thus, regardless of filing status as single, head of household, or married, your I bond tax refund purchase limit is $5,000.2

And note that this tax return privilege is for the Form 1040 only.

Creating Gift Boxes

You can buy I bonds as gifts, even as a gift for your spouse.

The annual $10,000 limit on electronic I bond purchases applies to the recipients (not to you).3

Example. You buy $10,000 of I bonds for your 11 grandchildren.

When you do this, you open 11 gift boxes at TreasuryDirect. The $10,000 in each gift box stays there until you deliver the gift. You won’t owe any 2022 gift taxes on the $10,000 because each $10,000 gift is under the $16,000 gift tax exclusion for 2022.4

Let’s say you open the gift boxes on September 24 and wait for a full year before delivering the bonds to the grandchildren. The bonds earn interest and compound in the gift box, just as they do for you (as described above).

Using the interest accumulations from the example above, each I bond one year later may be worth $10,953. If you deliver the gift when the bond is worth $10,953, the gift recipient’s basis is $10,000 and the deferred interest is $953. Remember, your gift tax exposure was when you put the $10,000 in the gift box.

The recipient receives the gifts with a holding date beginning at your date of purchase. Therefore, the grandchildren can cash the bond because they have held it for more than a year, although if they do that, they forfeit three months of interest (no big deal).

The Spouse Gift Strategy

As a reminder, you can gift any amounts to your spouse without worry of gift taxes, provided your spouse is a U.S. citizen.5

You can create gift boxes for your spouse. You can create more than one gift box for your spouse or any other person. But you can’t deliver the gift if your spouse or the other person has already contributed the $10,000 maximum for the year.

But here’s the deal: the money in the gift box earns interest and compounds while it’s in the gift box. That’s true whether you put $50 in one gift box or $50,000 in five gift boxes ($10,000 each).

So, let’s say you create a $10,000 gift box for your spouse, and one year from now it’s worth $10,953. And let’s say your spouse does the same: creates a $10,000 gift box for you, and one year from now it’s also worth $10,953.

Think of it this way: you have four accounts earning at the current high interest rates.

If the interest rates remain high, you can continue this strategy. But bear in mind that you can deliver no more than $10,000 of the original principal amount of the bonds each year to any gift-box recipient, so you have to be mindful of interest rates in future years.

Historical Rates for I Bonds

Here’s a look at the annual interest rates on I bonds from May 1, 2020, through May 1, 2022. (Remember, this May 1, 2022 rate applies to I bonds purchased from May 1, 2022, through October 31, 2022, enabling the 9.62 percent interest rate for six months from the date of purchase.)6

| Date Rate Set | Annual Interest Rate |

| May 1, 2020 | 1.06% |

| Nov. 1, 2020 | 1.68% |

| May 1, 2021 | 3.54% |

| Nov. 1, 2021 | 7.12% |

| May 1, 2022 | 9.62% |

As you can see from the chart, it’s likely that your I bond investments will produce well in the short term. The Federal Reserve is working hard to get inflation under control, and it has an inflation target rate of 2 percent. It’s going to take the Fed some time to get inflation under control; meanwhile, you likely will enjoy a high-performing interest rate harvest.

And you may remember that if you cash in the bonds before five years, you have to forfeit the last three months’ interest.

Let’s say inflation drops, and I bond interest rates drop to 3 percent. That rate could apply to the three-month penalty, making it even less of an infringement on your overall accumulation.

How the I Bond Works

The Treasury Department sets the I bond interest rate every six months, as you see in the table above. It is based on inflation changes in the non-seasonally adjusted Consumer Price Index for All Urban Consumers (CPI-U) for all items, including food and energy.7

You earn interest from the date of your purchase, based on the rate in effect on the date of your purchase.

The interest accrues (i.e., is added to the bond) until the bond reaches 30 years or you cash the bond, whichever comes first.8

The interest is compounded semiannually. Every six months from your purchase date, the interest your bond earned in the six previous months is added to the bond’s principal value, creating a new principal value. You then earn interest on the new principal balance.9

You can cash the bond after 12 months. But if you cash the bond before it is five years old, you lose the last three months of interest.10

Big Deal

It’s hard to find an investment that can’t decline in value. But the I bond is just such a financial instrument.11

- The I bond interest rate can’t go below zero.

- The I bond redemption value can’t decline.

Takeaways

You have much to like with the Series I bond. And there’s little to dislike. Perhaps the biggest dislike is the $10,000 limit on I bond purchases, but as you see in this article, you can use your business entities, trusts, gifts, and even your living trust to make purchases of I bonds and create a much higher limit than $10,000.

With the gifting strategy, you can have more than one gift box per donee, so you have opportunity there too.

The biggest deal with the I bond is that it carries no downside risk. It can’t go below its latest redemption value, and the interest rate can’t go below zero.

The one thing you need to pay attention to is the interest rate. It changes with inflation. The Fed wants to lower inflation to its target 2 percent. For most people, this means that the I bond could be a short-term investment—say, one to five years.

But think in the short term now. Where else can you earn 9.62 percent tax-deferred interest, risk-free?

- TreasuryDirect, Using Your Income Tax Refund to Buy Paper Savings Bonds.

- TreasuryDirect, Purchase Limits.

- Treasury Direct, Buying Series I Savings Bonds: How much in I bonds can I buy as gifts?

- Rev. Proc. 2021-45. Note that the 2022 amount will be adjusted for inflation for 2023.

- IRC Sections 2523(a); 2523(i)

- TreasuryDirect, Series I Savings Bonds Rates & Terms: Calculating Interest Rates.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- TreasuryDirect, Series I Savings Bonds FAQs.

Using Children’s IRAs to Pay for College

Using Children’s IRAs to Pay for College If your child has earned income (maybe from working in your business), you may want to consider establishing an IRA for your child. The IRA funds can, in turn, be used to help pay your child’s college expenses. When your child...

Clean Vehicle Credits

Clean vehicle credits can help car buyers pay less at the dealership RS Tax Tip 2023-123, Nov. 15, 2023 Taxpayers who buy a qualifying new or used clean vehicle may be able to transfer their tax credits to the dealer in exchange for a financial benefit – such as a...

NFT’s and Taxes

NFT's & Taxes Did you buy, sell, donate, or receive an NFT during the tax year? If so, you must answer “yes” to the digital assets question on page one of the IRS Form 1040. Additionally, if you have sold an NFT, you could be liable for tax or eligible for a...

Home Office Deduction

Home Office DeductionWith a growing number of business owners now working from home, many may qualify for the home office deduction, also known as the deduction for business use of a home. Usually, a business owner must use a room or other identifiable portion of the...

Cryptocurrency

Digital assets include (but are not limited to): Convertible virtual currency and cryptocurrency Stablecoins Non-fungible tokens (NFTs) Digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured...

IRS standard mileage rates for 2023 increases 3 cents per mile

IRS issues standard mileage rates for 2023; business use increases 3 cents per mileIR-2022-234, December 29, 2022 WASHINGTON — The Internal Revenue Service issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an...